America’s housing stock was primarily built for nuclear families, yet fewer and fewer households fit into that category, according to Making Room: Housing for a Changing America, a new report from AARP.

Vermont home prices reached new highs in 2018, continuing a four year trend of growth. However, household incomes have not kept pace, making it increasingly difficult for low and middle-income Vermonters to become homeowners.

Last week, VHFA Executive Director Maura Collins spoke on a housing panel at the Vermont Economic Conference in Burlington.

Vermont’s economy is growing but not in every county, and its gains have disproportionately benefited higher income Vermonters, according to the 2018 update of “State of Working Vermont” from Public

New estimates from the ACTION Campaign demonstrate the significant impact that the Low-Income Housing Tax Credit has had in Vermont, including creating and preserving over 7,000 affordable homes since 1986 and supporting nearly 8,000 jobs per year.

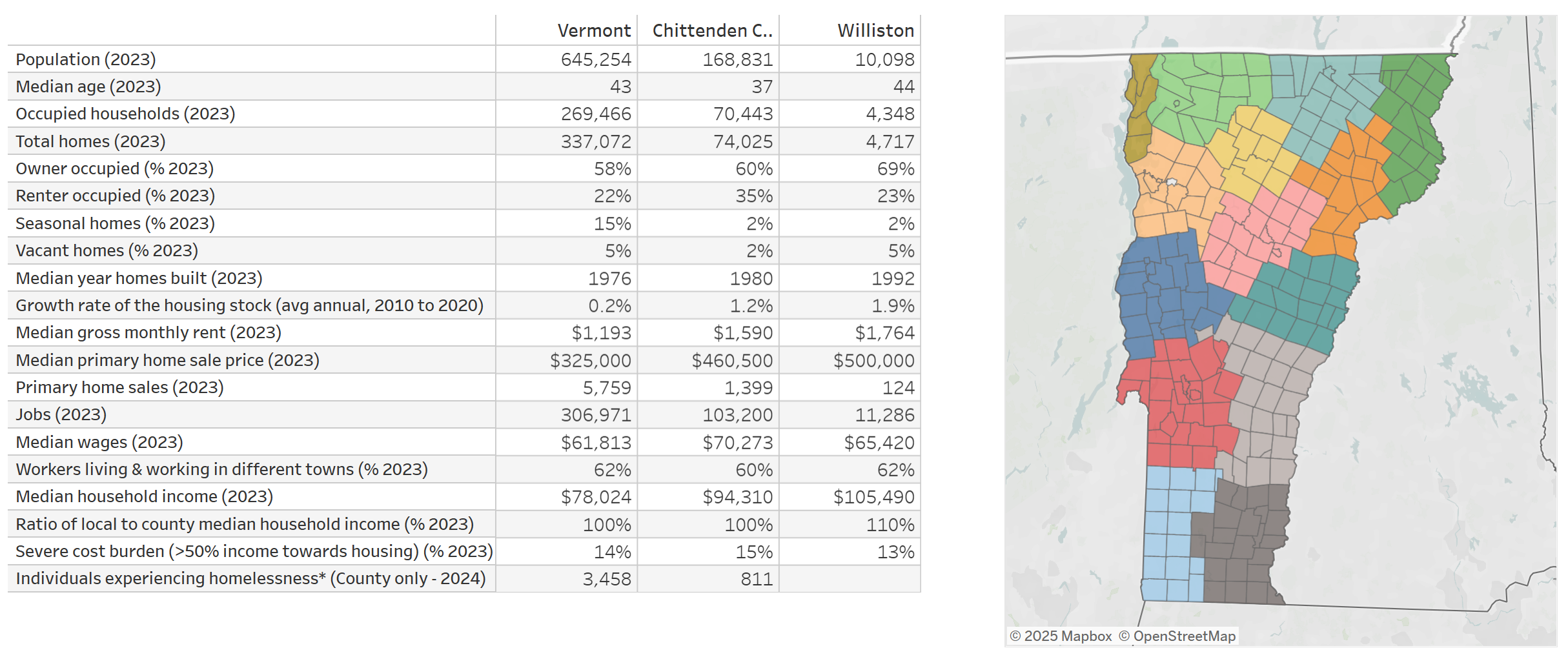

Vermont Housing Finance Agency (VHFA) announced today the launch of a robust, free resource connecting Vermonters to information about housing vacancies and community needs. Low and moderate income Vermonters who lack adequate, stable housing they can afford suffer elevated health and safety risks.

A recent article in the Burlington Free Press highlights Vermont’s stagnating household incomes, raising concerns over the strength of its economy and the ability of its residents to afford housing.

The annual report on housing from the Joint Center for Housing Studies of Harvard University (JCHS) reveals that although homeownership rates are beginning to climb, young adults are finding it increasingly difficult to afford to buy their first home.