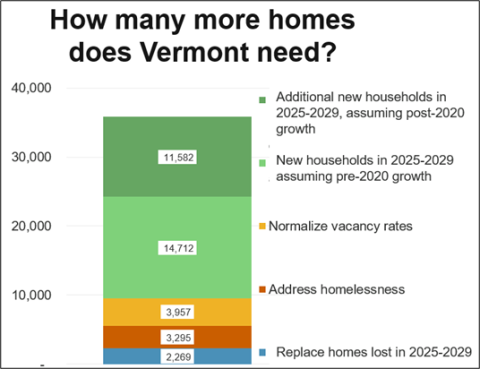

Compared to all other states, Vermont had the fourth highest rate of homelessness in 2024, according to HUD’s Annual Homelessness Assessment Report. For every 10,000 Vermonters, 53 experienced homelessness, based on the Point-In-Time count completed across the country in January. Hawaii, New York and Oregon had rates higher than Vermont. In 2023, Vermont’s homelessness rate was 51 per 10,000.

As in prior years, Vermont also had among the lowest rates of unsheltered homelessness in the country. Five percent of the people experiencing homelessness in Vermont were unsheltered, according to the HUD 2024 report. Only New York had a lower rate of unsheltered homelessness (4%).

Nationally, the number of people experiencing homelessness on a single night in 2024 was the highest ever recorded, with 771,480 people, or about 23 of every 10,000 people, in an emergency shelter, safe haven, transitional housing program or in unsheltered locations across the country. "Our worsening national affordable housing crisis, rising inflation, stagnating wages among middle- and lower-income households, and the persisting effects of systemic racism have stretched homelessness services systems to their limits," the report concluded.

Additional information on homelessness in Vermont and its regions is available on housingdata.org and in the recently completed 2025 Vermont Housing Needs Assessment.