The Housing Tax Credit was designed by Congress to help create and preserve affordable rental housing for lower income households. It provides a direct cost-based reduction in federal tax liability over a 10-year period for owners of qualifying rental housing who agree to conform to certain operating restrictions for a 15-year period or longer.

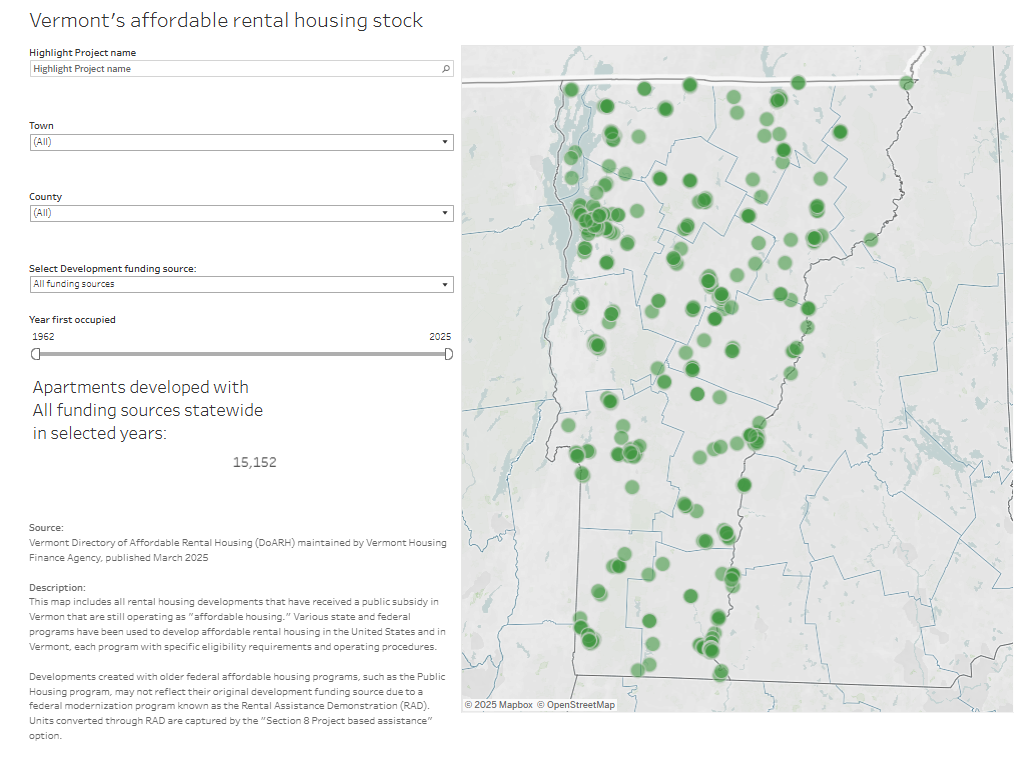

In the past, the federal government was the sole funder of the construction of many affordable housing developments. Today, dedicated affordable housing is usually created using subsidies from multiple sources, including federal, state, and local governments; financial institutions; and charitable foundations. Other dedicated affordable units are created as a result of affordability requirements or incentives established by local or state government.